Beyond the Balance Sheet: The Strategic Role of a CFO in Manufacturing

Indeed, in the modern manufacturing era, the role of a Chief Financial Officer (CFO) has evolved far beyond simple bookkeeping and tax compliance. Specifically, a CFO today acts as a “Strategic Navigator,” using real-time data from the ERP to drive profitability and operational efficiency.

As shared by Sangeet Gupta, here are the top 10 critical things a CFO must monitor and execute to transform a factory from a person-driven to a system-driven organization.

1. Ensuring Data Reliability Across Plants

Initially, a CFO must ask: “Which plant data is raliable?” Admittedly, showing a stock of ₹10 Crores is easy, but verifying its physical existence is the challenge. Notably, a CFO must motivate plant heads to ensure that the ERP data is a “Single Source of Truth.” If the system reports a stock, the CFO should be able to say with confidence, “This is correct because our internal audits are robust.” Roles and Responsibilities of a CFO in Manufacturing

2. Managing Inventory Ageing and “Locked” Capital

Furthermore, a CFO must be the guardian of the company’s working capital. Typically, money gets trapped in slow-moving inventory, rejected customer stock, or forgotten raw material reels.

-

Audit Step: Regularly review Inventory Ageing Reports.

-

Action: Identify materials over 90 days old and push for their consumption or disposal. As a result, you reduce storage costs and interest burdens.

3. Bank Interest and Sanction Letter Audits

Typically, companies accept bank interest charges without verification. On the contrary, a strategic CFO audits the bank statement against the official Sanction Letter.

-

The Check: Is the bank charging 8.2% when the letter says 7.5%?

-

Impact: Over a large loan corpus, even a 0.5% discrepancy can lead to massive annual losses. Indeed, this is one of the “rare” deductions where the CFO can directly save the company money with one email to the bank manager.

4. Monitoring Internal Rejections and PPM

Admittedly, quality control is often seen as a production-only job. However, high rejection rates lead to financial leakage. A CFO must review:

-

In-house Rejection Reports: Tracking the cost of “Muda” or wastage.

-

Customer PPM (Parts Per Million): Reducing rejections saves logistics costs and protects the company’s brand value.

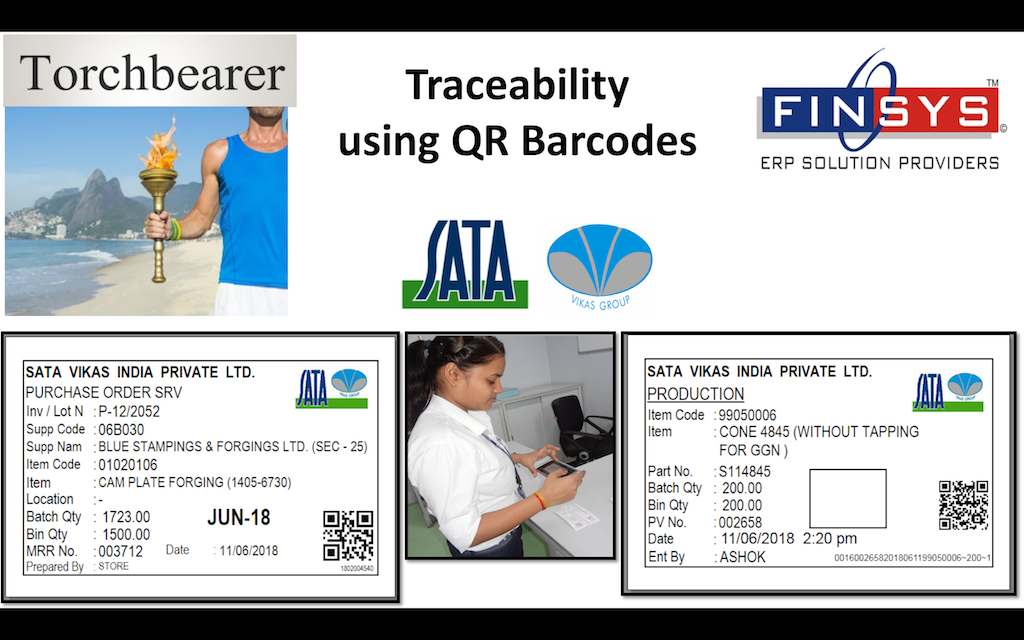

5. Fixed Asset Verification and Barcoding

Furthermore, a CFO must ensure that the “Fixed Asset Register” in Accounts matches the physical reality on the shop floor.

-

Action: Implement QR/Barcode tagging for every machine, transformer, and vehicle.

-

Goal: Aim for at least 10% physical verification every month to ensure assets haven’t been retired or scrapped without financial recording.

6. Strategic Vendor and Customer Relationships

Ultimately, a CFO’s desk should not be the end of their world. By meeting top-tier (Category A) vendors and customers, a CFO can:

-

Resolve long-standing payment or rate discrepancies.

-

Negotiate better credit terms or cash discounts.

-

Understand the “Financial Health” of their supply chain partners.

7. Compliance and Statutory Discipline

Notably, late filings lead to penalties and a loss of GST credit for customers. A CFO must set an Internal Due Date—for example, treating the 7th of the month as the deadline for a task that is legally due on the 10th. Consequently, you ensure “Ease of Doing Business” and 100% compliance without last-minute panic.

8. Item-Wise Profitability Analysis

Typically, a company might be profitable overall while losing money on specific products.

-

CFO Mandate: Review the Gross Profit (GP) per Item.

-

Red Flag: If an item’s GP is below 30% or negative, it requires an immediate “Make or Break” decision with the marketing team.

9. Leveraging Innovative Schemes (NPS)

Furthermore, a CFO should look for tax-efficient ways to benefit the staff. For instance, implementing the NPS (National Pension System) under Section 80CCD(2) provides social security to employees at no extra cost to the company while saving significant income tax for both the employer and employee.

10. The Power of “Drill-Down” MIS

To conclude, a CFO must use an ERP that allows for “Drill-Down” reporting. Instead of asking “Why is collection low?”, the CFO should be able to click on the collection tile and see exactly which customer has delayed payment.

So These are the Roles and Responsibilities of a CFO in Manufacturing

Watch the Full Training Video: Roles of a CFO – Top 10 Ideas

3. Outro & Call to Action

Ready to Empower Your Finance Department?

-

Official Website: Finsys Infotech Pvt Ltd

-

Explore More Insights: Finsys YouTube Community

-

Get a Demo: Transform Your Finance with Finsys – Contact Us

Successful Bar Code Implementation using Finsys ERP

Successful Bar Code Implementation using Finsys ERP