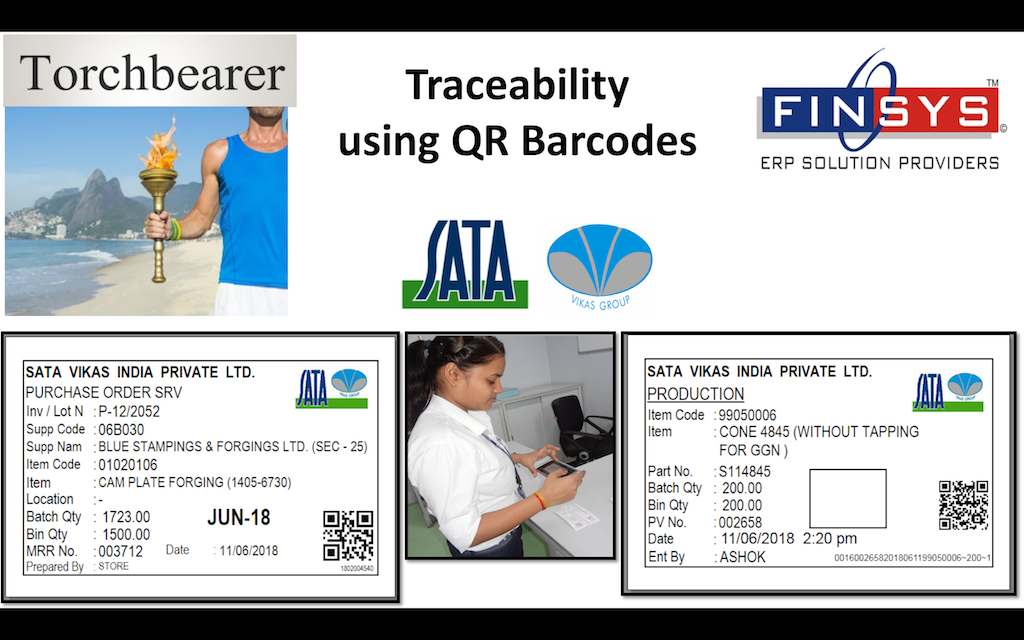

How to Implement Traceability in Automotive Industry, Barcode, QR Code, using simple Scanning Process

Successful Bar Code Implementation using Finsys ERP

Successful Bar Code Implementation using Finsys ERP

Preparation of Barcode Sticker of Incoming Raw Material

Printing of Bar Code Sticker from RM to Production WIP to Finished Goods QC and to Despatch

In a User Friendly way, learn yourself on

Watch how you can move the material from Raw material stage to Finished Goods Stage, with full Traceability

The Success included the following ideas

Finsys ERP’s extension, with the Barcode Mobile App which is used for following Movement

-Incoming QC

-Binning of Material Placed in Location

-Issuance to Production

-OK / Line Rejection Return to Store

-Material Received in Store

-Q/C of FG Material

-FG Received in Bond Store

QC of Incoming Raw Material through Mobile App by Quality Person

After QC Checked Sticker Paste on Raw Material Bins

After QC of Raw Material Binning Done by Store Person and Placed on Location

And Raw Material Stock updated automatically

Raw Material Picked Through Mobile App by Logistic and issued to Production

And Raw Material stock will reduce automatically

Raw Material Picked Through Mobile App by Logistic and issued to Production

Entry saved without FiFo System

Before FiFo System Entry Saved.

After that Implement FiFo System for Raw material Picking and issuance.

Production Voucher Prepared through Bar Code by Production after Producing the Finished Goods

After Preparation of Production Voucher Automatically mails goes to concerned department

First Mail goes to QC Person where he can know that Finished Goods Ready for QC

Barcode Sticker paste on Finish Goods Bins

QC Checked of Finish Goods Through Mobile App by Quality Person

After QC Checked of Finish Goods Mark OK Stamp on Bar Code Sticker

After QC of Finish Goods Received by Store Person through Mobile App

After QC of Finish Goods Material Received Through Mobile App by Store Person

And Finished Goods updated automatically

Congratulations to SATA Vikas, Palwal, Haryana, India for accomplishing Traceability successfully.

Success of Man+Machine+Material+Method, in order to be successful in generating More Money+ More Motivation through Success

Tip of the day

Tip of the day